Robinhood, an online brokerage app named after a folk hero who steals from the rich to give to the poor and whose mission is to “democratize finance for all,” barred the purchase of old-school video game store, GameStop amid a coordinated effort from redditors to drive up the stock prices of certain companies such as Blackberry, AMC, American Airlines.

An army of traders on the Reddit forum r/WallStreetBets helped drive a meteoric rise in GameStop’s stock price in recent days. Trading of GameStop has halted multiple times over the last week because the stock price has jumped so quickly it’s triggered market protections.

On Monday, the stock surged again, opening at $96 and then jumping to $159 an hour later, its highest-ever price. By the end of the day, it was back in the $70s. On Tuesday, it opened at $88 and jumped 90% by close. In after-hours trading, it jumped another 50%, to over $230. A year ago, the share price was $4.

“We continuously monitor the markets and make changes where necessary,” Robinhood said. “In light of recent volatility, we are restricting transactions for certain securities to position closing only. We also raised margin requirements for certain securities.”.

In recent days, investors on the subreddit r/WallStreetBets have managed to drive up the stock price for a number of companies to the detriment of hedge funds betting against these stocks.

This essentially locks out potential new buyers and forces existing holders to sell. The stock dropped 70% at one point. Robinhood is protecting big hedge funds from further losses and taking advantage of the smalltime investors.

Robinhood is not the only major trading company that has limited transactions for these stocks, whose price surge Reddit users have said will help them pay off student debt and medical bills, among other things. TD Ameritrade and Charles Schwab also placed similar restrictions on Wednesday.

As Bloomberg put it, “it’s a humbling turnaround for the hedge fund titans, who in 2020 staged a comeback by pouncing on the wild markets caused by the COVID-19 pandemic. But that crisis helped push thousands if not millions of retail traders into the U.S. stock market, creating a new force that for now the professionals seem powerless to combat.

Hedge Fund Billionaire is not happy with the Stay-at-home investors. He said “The reason the market is doing what it’s doing is people are sitting at

home getting their checks from the government, okay, and this fair share is a bullshit concept, It’s just a way of attacking wealthy people. It’s inappropriate and we all gotta work together and pull together.”

The small-time investors have no sympathy with billionaires, having made life-changing money by betting on the stock. If exchanges halted trading in GameStop, it would only result in other stocks soaring on similar sentiment, just as BlackBerry and AMC have done.

And whilst people have turned to other trading platforms like Cash App and Webull, 600,000 people downloaded The Robinhood app on Friday alone. It also experienced record growth during some of the most challenging days operationally this past week.

But perhaps the biggest winner has been the Real Estate market, where people have turned to as their investment mechanism of choice, since it is far less risky, yet still produces high yields. And whereas this article will be obsolete in future, real estate investment will always remain relevant.

Related stories

Winter vs. Spring in the GTA Housing Market

In Real Estate, timing is key. You may have the perfect house to sell, in a desirable location, but if you sell it at the wrong time, you may end up receiving tens or even hundreds of thousands of dollars less than you should. Traditionally, Spring has always been the best time to sell, with […]

Predictions for Canadian Real Estate In 2022!

We are witnessing one of the most unpredictable markets in the history of Canadian Real Estate. Given the importance to us all, we took the liberty in putting together our predictions to help us all safeguard what matters most. But first, let’s take a look at how we got here. Since 2010, the year […]

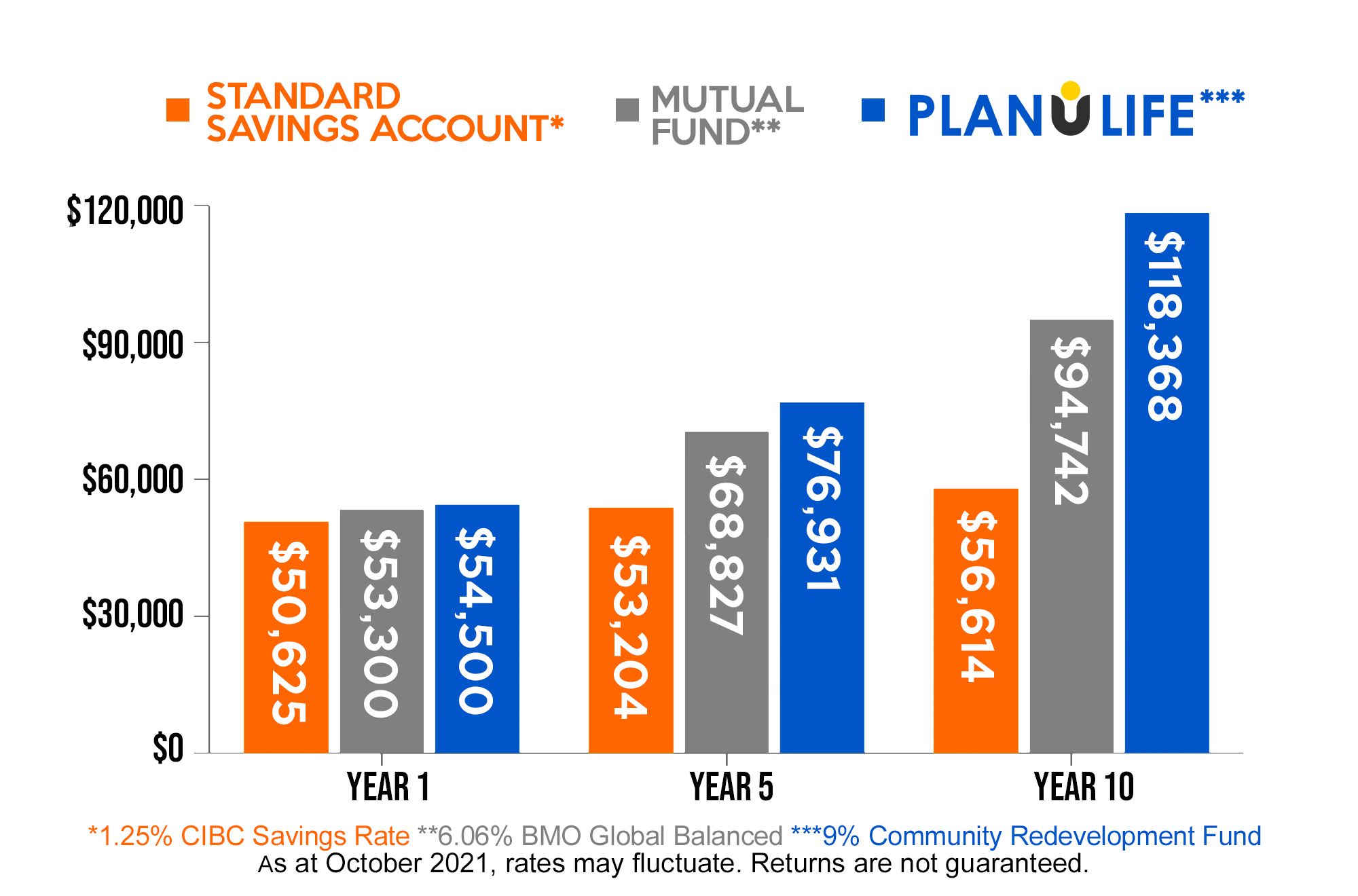

Planulife’s Community Redevelopment Fund vs Other Investments

The Planulife Community Redevelopment Fund (“Redevelopment Fund”) was created to provide our members with high yield income fund returns with minimal risk. With mortgage security across a pool of community redevelopment sites, the returns are both reliable and understandable for most people, especially those that have made mortgage payments before. The Redevelopment Fund was designed […]