Related stories

Winter vs. Spring in the GTA Housing Market

In Real Estate, timing is key. You may have the perfect house to sell, in a desirable location, but if you sell it at the wrong time, you may end up receiving tens or even hundreds of thousands of dollars less than you should. Traditionally, Spring has always been the best time to sell, with […]

Predictions for Canadian Real Estate In 2022!

We are witnessing one of the most unpredictable markets in the history of Canadian Real Estate. Given the importance to us all, we took the liberty in putting together our predictions to help us all safeguard what matters most. But first, let’s take a look at how we got here. Since 2010, the year […]

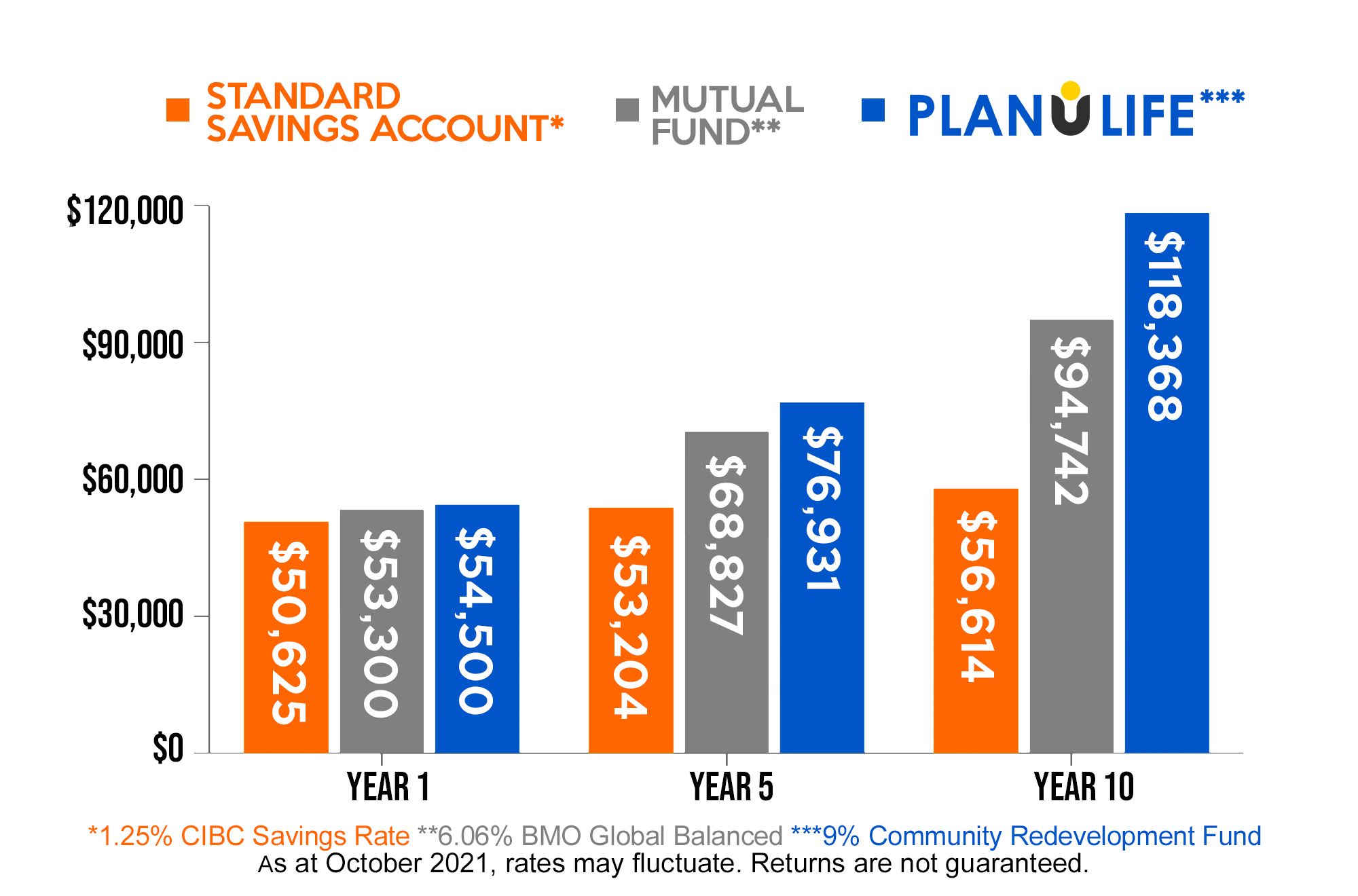

Planulife’s Community Redevelopment Fund vs Other Investments

The Planulife Community Redevelopment Fund (“Redevelopment Fund”) was created to provide our members with high yield income fund returns with minimal risk. With mortgage security across a pool of community redevelopment sites, the returns are both reliable and understandable for most people, especially those that have made mortgage payments before. The Redevelopment Fund was designed […]