Widget Subscription

Investment is the allocation of money and assets acquired for future income and with the hope that it will provide some benefit in the future. You have a lot of options for where to invest your money as an investor. However, it is essential to invest them carefully. Investments are for the most part bucketed into three main classes: stocks, bonds, and holding cash and equivalents. There are numerous approaches to invest in each can. These are the three major types of investments:

1. Stocks Investment:

A stock is an investment in a particular organization. When you buy a stock, you’re purchasing a share (a piece of the company) of that organization’s income and resources. Organizations sell shares of stock to raise money for their businesses; investors would then be able to purchase and sell those shares among themselves. Some of the time stocks earn returns, but they generally prove to be more risky investment. Due to this companies can go out of business and lose esteem.

How investors make a profit:

Stock investors earn profit when the price of the stock they possess goes up and investors sell that stock for a benefit. A few stocks also pay profits, which are regular earnings to the shareholders. The stock of the price changes day by day, if the owner owns a stock and the price of the stock increases, they can sell it and make a profit from it. As an investor, you have a case on an organization’s income after debts are paid. This is an essential element of stocks and separates them from bonds and money.

2. Bond Investment:

A bond is a type of loan that you make to an organization or government. When you buy a bond, you’re enabling the bond giver to take your cash and pay you back with a profit. Bonds are for the most part thought to be more secure than stocks, but they offer lower returns. The main risk, likewise with the loan, is that the provider could default. U.S. government bonds are sponsored by the “full confidence and credit” of the United States, which successfully wipes out that risk. The more secure the security, the lower the loan fee.

How an investor make a profit from bond:

As investors expect regular income earning, the bond is fixed earning investment. All the interest is commonly paid to investors in fixed installments — normally more than once per year. A bond provides more money and benefits if the economy cools and fall in interest rates.

3. Mutual Funds:

If you are not in the condition of purchasing stocks and bonds then there is one other kind of investment called mutual funds. Mutual funds enable investors to buy an enormous number of interests in a single transaction. These assets pool cash from numerous investors, at that point utilize an expert supervisor to invest that cash in stocks, bonds or different resources.

How investors make a profit:

When a mutual fund acquires cash — for instance, through shareholders or bond interest it appropriates an extent of that to investors. At the point when interests in the reserve go up in worth, the estimation of the fund increments also, which means you could sell it for a benefit. Keep in mind that you’ll pay an annual charge to invest in a mutual fund called expense proportion.

Related stories

Winter vs. Spring in the GTA Housing Market

In Real Estate, timing is key. You may have the perfect house to sell, in a desirable location, but if you sell it at the wrong time, you may end up receiving tens or even hundreds of thousands of dollars less than you should. Traditionally, Spring has always been the best time to sell, with […]

Predictions for Canadian Real Estate In 2022!

We are witnessing one of the most unpredictable markets in the history of Canadian Real Estate. Given the importance to us all, we took the liberty in putting together our predictions to help us all safeguard what matters most. But first, let’s take a look at how we got here. Since 2010, the year […]

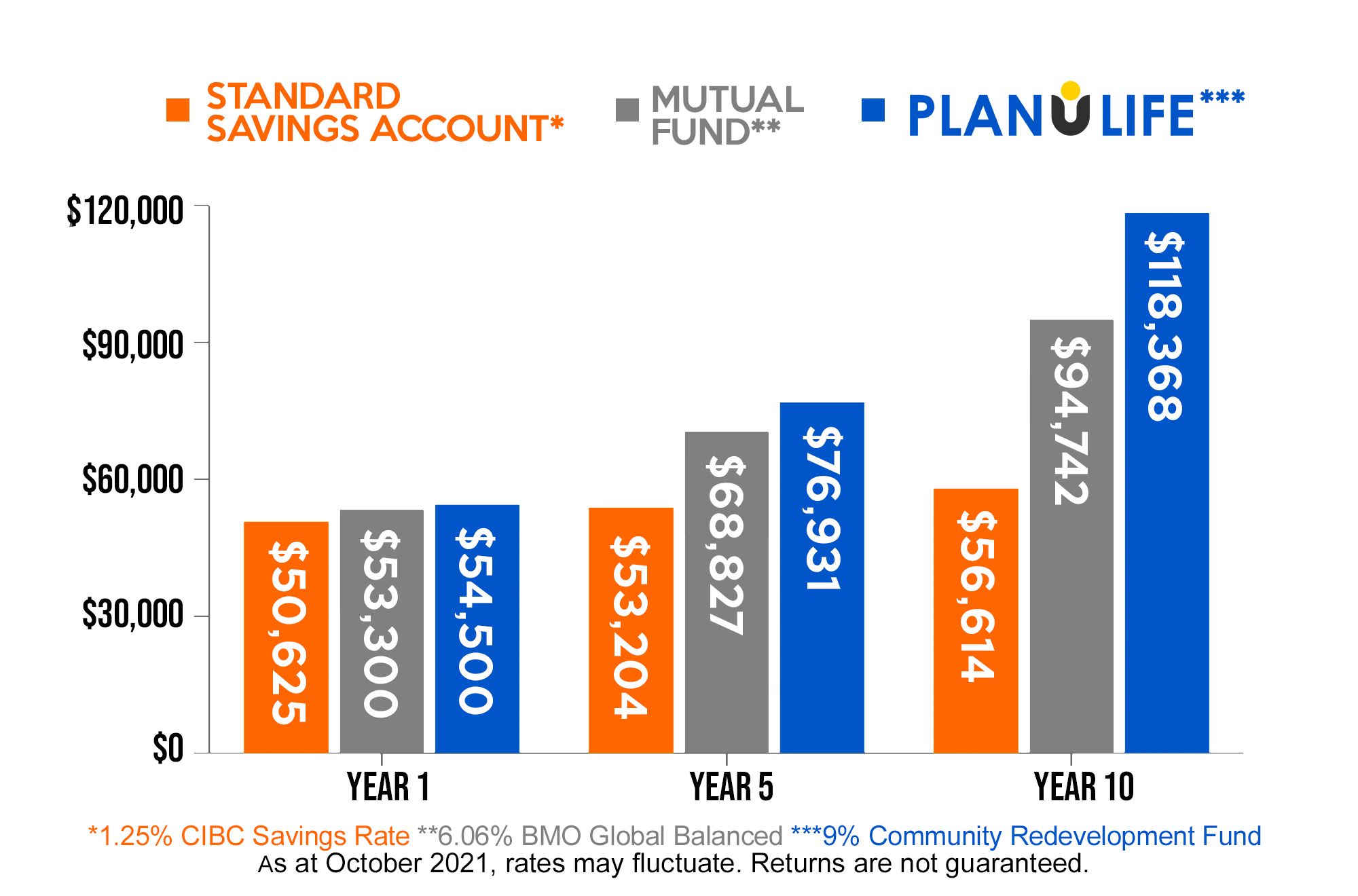

Planulife’s Community Redevelopment Fund vs Other Investments

The Planulife Community Redevelopment Fund (“Redevelopment Fund”) was created to provide our members with high yield income fund returns with minimal risk. With mortgage security across a pool of community redevelopment sites, the returns are both reliable and understandable for most people, especially those that have made mortgage payments before. The Redevelopment Fund was designed […]