The Planulife Community Redevelopment Fund (“Redevelopment Fund”) was created to provide our members with high yield income fund returns with minimal risk. With mortgage security across a pool of community redevelopment sites, the returns are both reliable and understandable for most people, especially those that have made mortgage payments before.

The Redevelopment Fund was designed to provide reliable income for a variety of reasons:

- To help first time home buyers with savings towards their home purchase

- Help Canadians earn tax efficient income through registered accounts, such as a Tax Free Savings Account (TFSA) or Registered Retirement Saving Plan (RRSP)

- Help Canadians with supplemental income in retirement

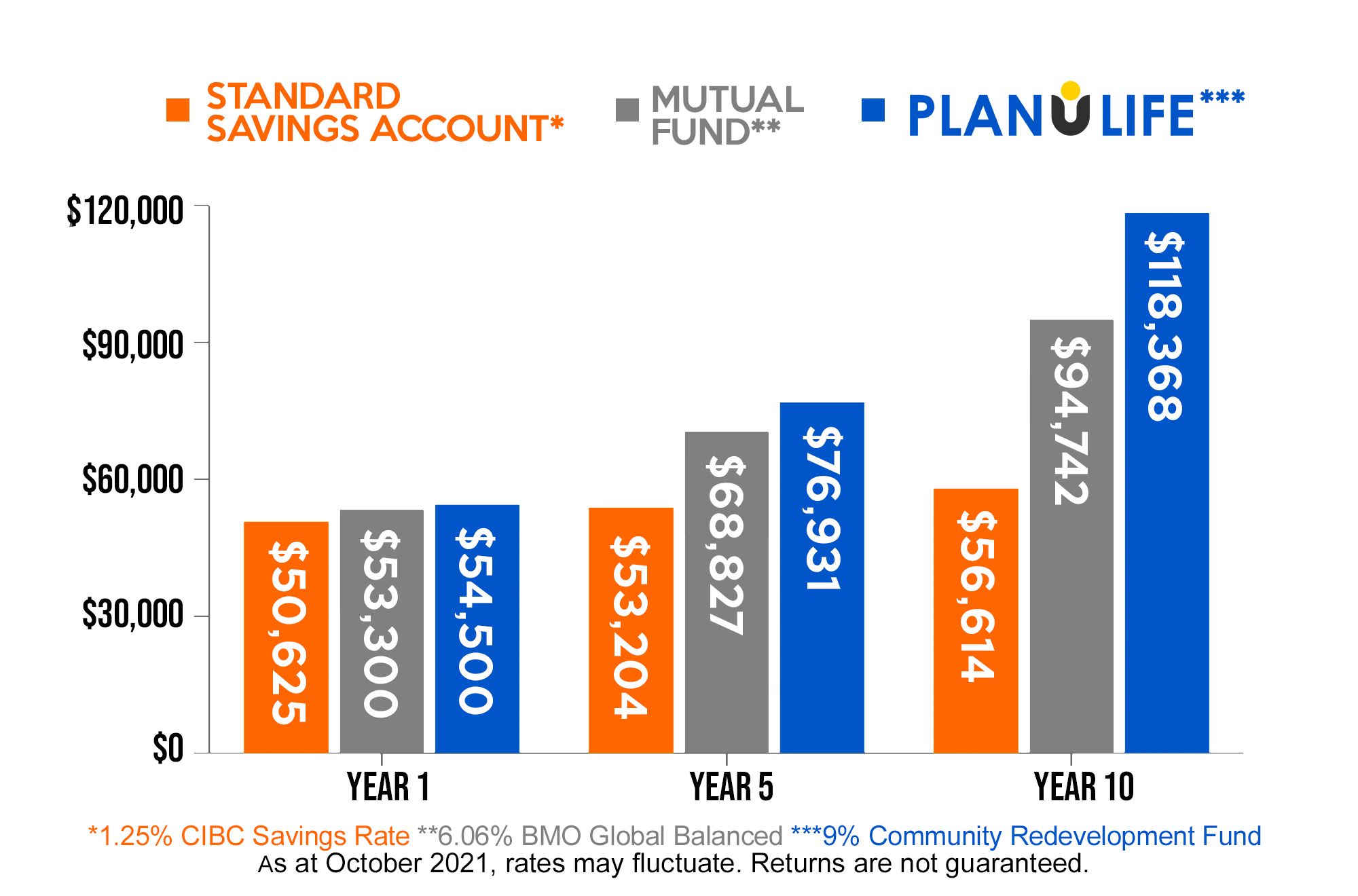

Let’s analyze how the Redevelopment Fund stacks up against other investments:

Private lending

There is a significant difference between investing to create housing and lending to homeowners that need access to extra private funds. For starters, the social benefit of creating housing is commendable in current times where we have a severe housing shortage. On the other hand, debt levels are at all time highs with consumer spending out of control. Here are some of the product differentiators showcasing the difference in risk:

Yields can be similar depending on the risk associated with the private lending deal. The Redevelopment Fund yields a 9% net return, whereas private lending ranges from 7% to 11% through a broker network. For a private lender to net 9%, the homeowner will likely pay upwards of 13%+ APR (9% monthly, 2.5% broker fee, legal and appraisal fees).

Bond alternatives

A private corporate bond is the one of the most similar investments to the Redevelopment Fund. The Redevelopment Fund has an added advantage that ensures Management allocates investor funds to the community redevelopments up to 75% loan-to-value, whereas in a corporate bond funds can typically be used for a much broader use.

Here are some of the product differentiators showcasing the difference in risk:

| Corporate Bond |

Redevelopment Fund |

| Asset security may be minimal |

100% of investor funds are secured by real estate |

| Usually inaccessible by general public |

Targeted to a variety of investors |

| Set maturity date |

Open fund for long term |

| Locked in to maturity, may be sold |

Fully open with 90 days notice |

Private corporate bonds can range quite a bit in return given the variety of business types. Public corporate bond returns can be a bit lower given the regulatory reporting costs, however, as examples, Tesla bond maturing in 2025 is at 5.3% or a Mattamy bond maturing in 2028 yields 4.625%. Note, the Redevelopment Fund yields 9% because it is private so regulatory and reporting costs are much lower, the Builder covers all investment expenses, and Planulife executes aggressive development and construction yielding higher returns.

Real estate investment trust (REIT)

Although a private REIT has similarities with the Redevelopment Fund, there are some significant differences from a risk perspective. REITs own and manage income-producing commercial real estate generating both dividend income and capital appreciation. There are a variety of specialist REITs, such as retail, healthcare, and hotels.

The key difference is that the Redevelopment Fund provides mortgage security, transferring all operational risks to the Builder. As such, the Redevelopment Fund generated the targeted 9% return even during the recent covid pandemic, whereas most REITs income was significantly lower due to tenant defaults.

Rental property

Rental properties were quite popular over the past decade taking advantage of the real estate boom. With current market values, even with low interest rates, rental properties are mostly not cash flow positive even at 80% loan-to-value. Rental properties do provide principal paydown and capital appreciation but you’d likely want to maximize your Tax Free Savings Account (TFSA) before signing up to be a slumlord. Let’s look at some of the key differences between a rental property and the Redevelopment Fund.

| Returns impacted by interest rates and capital appreciation |

Reliable returns |

| Active income – Manage tenants and perform capital expenditures |

Passive income |

| Require mortgage approval |

No strings attached |

| Not registered account eligible, capital gains tax on sale |

Registered account eligible, income tax annually |

| Tough to liquidate and repurchase |

Fully open with 90 days notice |

Numerical example:

John purchased a detached rental property in Oshawa, Ontario for 475,000 in 2015. Although market rent is $2,750, the current tenants have been in since 2017 and are paying $2,300. Market value for the home is currently $1,000,000. John is retiring this year and wants to have some supplemental income in addition to his pension.

John’s Monthly Cash

Out of his proceeds, John invests $75,500 in his and his wife’s new TFSAs. The balance of his investment proceeds $478,800 ($629,800-$151,000) are a non-registered investment. John opted to collect monthly returns at 8.25% totalling $4,329 monthly. John and his wife receive T5 income slips totaling $39,501 annually paying approximately $8,750 in annual income tax. Not bad on annual earnings of $51,948!

Balanced Mutual funds

Balanced mutual funds contain a variety of stocks and bonds and are a popular way to generate passive income from the public markets. But, do you actually know where your money goes? How is it secured? Do you believe in the mission of the underlying companies and will they be reliable in the long run? There are a variety of types of mutual funds but one thing they all have in common is volatility, and so unless your favorite past-time is riding roller coasters at Wonderland you may want to skip the ride.

Here are some of the product differentiators showcasing the difference in risk:

| Mutual funds |

Redevelopment Fund |

| Asset security may be minimal |

100% of investor funds are secured by real estate |

| Stocks and/or bonds (fixed income) |

Fixed income only |

| Liquid |

Fully open with 90 days notice |

| Volatile based on stock market fluctuations |

9% Target return set at mortgage contract rate |

Mutual funds are very common holdings for investments that were set up through employer pension plans and/or RRSP holdings. The funds are aimed at yielding a decent return over long periods of time, however, due to short term market fluctuations and annual fees, most investors target 6% to 7% over the long run in a balanced mutual fund. This can be a significant difference in retirement. Let’s compare a balanced fund yielding 6.5% to the Redevelopment Fund.

The above examples are all reasonable considerations for investors that want to plan towards their investment goals. Given that the Redevelopment Fund is a stable income fund, it is incomparable against speculative investments such as crypto, day trading stocks and pre-construction flips. To find out more about our Redevelopment Fund, view our factsheet, or to open your investment portfolio with Planulife, please reach out to one of our agents.

Related stories

Winter vs. Spring in the GTA Housing Market

In Real Estate, timing is key. You may have the perfect house to sell, in a desirable location, but if you sell it at the wrong time, you may end up receiving tens or even hundreds of thousands of dollars less than you should. Traditionally, Spring has always been the best time to sell, with […]

Predictions for Canadian Real Estate In 2022!

We are witnessing one of the most unpredictable markets in the history of Canadian Real Estate. Given the importance to us all, we took the liberty in putting together our predictions to help us all safeguard what matters most. But first, let’s take a look at how we got here. Since 2010, the year […]

Planulife’s Community Redevelopment Fund vs Other Investments

The Planulife Community Redevelopment Fund (“Redevelopment Fund”) was created to provide our members with high yield income fund returns with minimal risk. With mortgage security across a pool of community redevelopment sites, the returns are both reliable and understandable for most people, especially those that have made mortgage payments before. The Redevelopment Fund was designed […]