We are witnessing one of the most unpredictable markets in the history of Canadian Real Estate. Given the importance to us all, we took the liberty in putting together our predictions to help us all safeguard what matters most. But first, let’s take a look at how we got here.

Since 2010, the year I got my realtor’s license, I witnessed Toronto’s average price increase by 154% from $431K up to $1,095K! I vividly remember that day in 2010, in my commercial real estate class when the professor said – “Put up your hand if you think the Toronto market will BOOM over the next 3 years. Put up both hands if you think it will BOOM, BOOM. Stand up if you think it’s going to BOOM, BOOM, BOOM” As I sat in my seat, both hands on the desk, I was puzzled but intrigued to get in on the ride.

The professor was the only one standing because he knew the Toronto market was undervalued. And with low interest rates post recession the market was ready to skyrocket!

For the next 5 years, the market soared 44%. Then in 2016 and 2017, foreign funds propelled the market to even new heights, up 32% more in 2 years.

When the influx of foreign money dried up in 2018 and 2019, what no one dares to talk about is that the market was flat! No growth, and in fact, many markets suffered significant losses up to 30% declines. Then, the pandemic took us to new heights! 31% more in 2 years… What’s next?

2022 Predictions

We predict the market to stabilize in the near future. When it does, some geographic areas and housing types will have price corrections. In the fall of 2021, we wrote about deflationary pressures on market pricing.

Read Article

For the current prediction, we have analyzed some key market indicators from our investing, realty and financing viewpoints.

Housing demand

The pandemic led us all to heighten the importance of our living conditions, creating long-lasting value for home ownership. In the short run, increased levels of demand will remain with a sellers market, but star(t)s are aligning to a more stable market. The widening of suburban sprawl has also changed the definition of ‘location, location, location’ shifting value into remote communities. A resurgence of housing starts with almost 300,000 in 2021 indicates that supply is recovering from pandemic delays. With a backlog of 1.8 million applicants, immigration can help sustain demand for years to come.

Interest rates

The Bank of Canada didn’t raise interest rates in 2021 because of the pandemic, but the perceived risk did enough harm. Banks took the liberty to increase their fixed rates across the board, on average by more than 1%. In early 2021 a 5-year fixed at 1.7% was standard, but now it climbed up to 2.7%. The increased rates will eventually have to adjust with home prices.

Income

While the market jumped 154%, income levels have remained relatively stable. This has made entering the market for newcomers extremely difficult. First time buyers are getting record amounts of assistance from family to make purchases.

What does this mean for you?

The importance of planning is ever so important. If you’re thinking of downsizing, now may be a great time to cash out of the market while values remain high. If you’re thinking of buying your first home or upsizing, make sure you buy into the right geographic area and type of home. Investors, create an overall plan for your objectives to avoid speculation and taking unnecessary risks.

Planulife uses technology to put your investment, realty and mortgage on autopilot. Contact your Planulife Advisor to get started.

Related stories

Winter vs. Spring in the GTA Housing Market

In Real Estate, timing is key. You may have the perfect house to sell, in a desirable location, but if you sell it at the wrong time, you may end up receiving tens or even hundreds of thousands of dollars less than you should. Traditionally, Spring has always been the best time to sell, with […]

Predictions for Canadian Real Estate In 2022!

We are witnessing one of the most unpredictable markets in the history of Canadian Real Estate. Given the importance to us all, we took the liberty in putting together our predictions to help us all safeguard what matters most. But first, let’s take a look at how we got here. Since 2010, the year […]

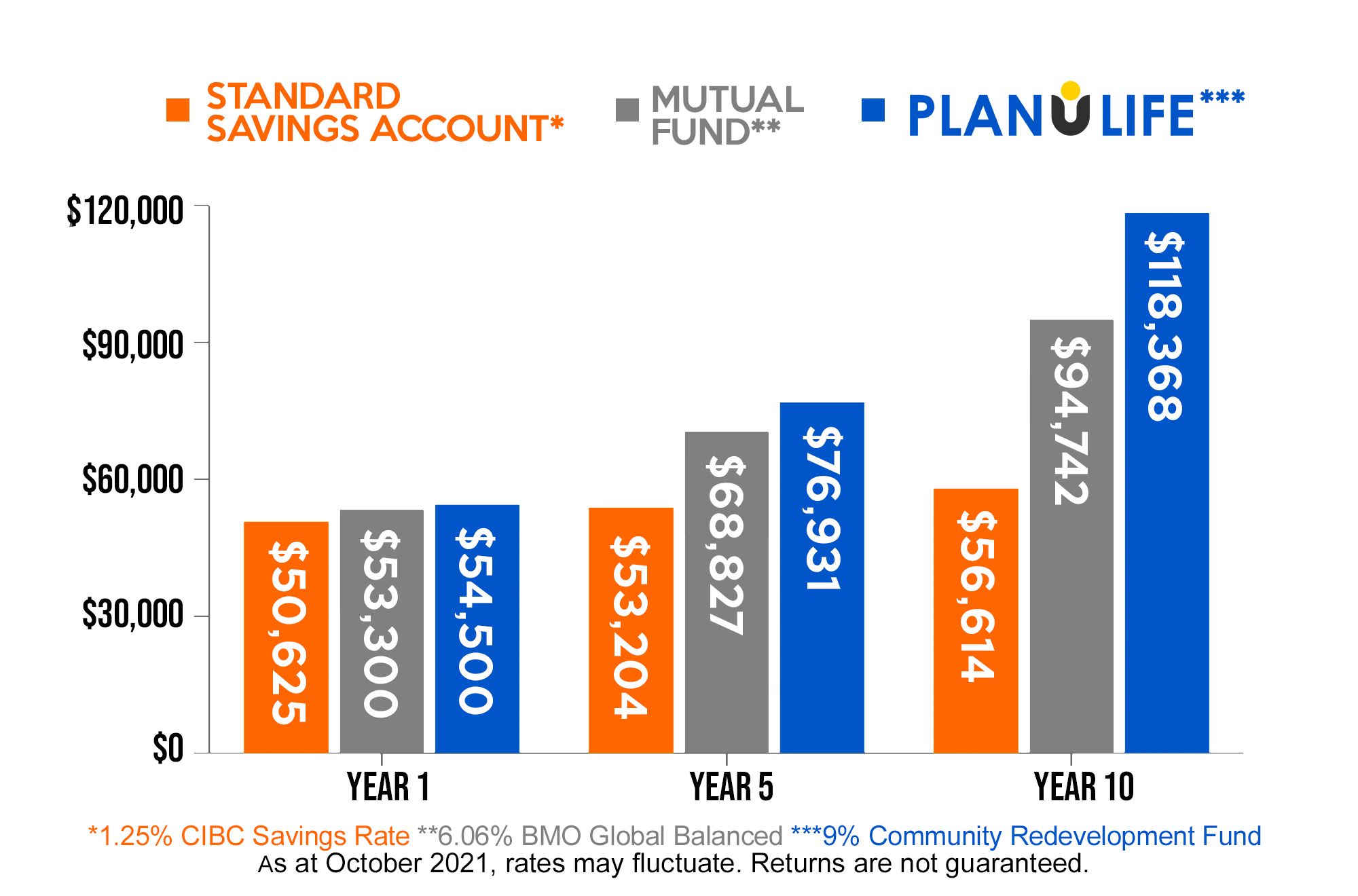

Planulife’s Community Redevelopment Fund vs Other Investments

The Planulife Community Redevelopment Fund (“Redevelopment Fund”) was created to provide our members with high yield income fund returns with minimal risk. With mortgage security across a pool of community redevelopment sites, the returns are both reliable and understandable for most people, especially those that have made mortgage payments before. The Redevelopment Fund was designed […]